by Kasia | Aug 2, 2016 | Writing

Do you write? Would you ever go as far as calling yourself a writer? Maybe you’re an ‘in the closet’ type of writer? Weekend only? Holidays? Monday through Sunday, early morning and late nights? Whatever type of writer you are, it’s time you own the title, it could change your life.

I’m a writer. I’m an author.

It’s taken a while to own up to those terms. I might not invent a life saving machine or something on par with Branson’s out of this planet joy ride, but I’m doing what brings me a sense of satisfaction. How about you?

It’s taken a while to own up to those terms. I might not invent a life saving machine or something on par with Branson’s out of this planet joy ride, but I’m doing what brings me a sense of satisfaction. How about you?

Here are five ways to tell you’re a writer.

1 – You write every day (or once a week)

Writers write. They don’t talk about writing, they do it. Those that don’t generally like the idea of having been written but not the actual process. I like a bit of both but over the years I have learnt that the words aren’t going to write themselves, duh! So I try to write everyday whether that’s working on a novel, writing articles, blog posts or brainstorming plot development.

But writing everyday isn’t a necessity. We all have different lifestyles. Maybe you only have time on Saturday at 9am. That’s fine. You’re still a writer.

2 – You carry a notebook and pen in your bag along with your lap top

You never know when an idea will pop into your mind. Having both a laptop and notebook on hand means you’re prepared for any situation.

Only the other day I went to my weekly writing haunt, early morning sunrise on the beach and my laptop battery turned out to be dead. Fortunately, I had the trusty notebook and two pens, so the writing session did not go to waste. There’s also the Notes system on my smartphone, and the notebook by the bed. Let’s just say there’s always something to write on until an idea hits and I’m in a place where there’s nothing to jot the genius on.

Hold on, we live in the tech age, we’ve always got out trusty phones on us, don’t we?

3 – You’re constantly coming up with story ideas

Is your brain a well of ideas for stories, articles and books? Do you find yourself running out of hours in the day to get everything down on paper? You’re a writer. Own it.

At the moment there are ideas floating in my mind for three different series and it’s driving me crazy because I want to write them all like write now. That’s not possible. I did manage to outline an entire novel in the first book of one of the series on the hour train ride to work. Win!

4 – You have a journal, a blog, a website, ten unfinished manuscripts in the bottom drawer (or maybe just one)

Yes, you are a writer. Even if you haven’t been ‘traditionally published, you can claim the title. It’s no longer a closely guarded community. Writers are versatile, they are flexible, and they come from all walks of life in various shapes and sizes. From freelancer to author and blogger.

It doesn’t matter what you write, how you write it or when you write it, as long as you do.

You are a writer. Stop denying yourself the title.

5 – Your stories are the first thing you think of and the last thing before you go to bed at night

It’s hard to forget a project you are passionate about. Even when you’re not sitting down at your desk you are thinking about your story, mulling over the details and hoping your dreams might bring a resolution to the conflicts you have set for your characters. You are a writer.

I often go to bed early just so I can think about my characters and the nasty situations I want to put them into so they can fight to get out of them and come out stronger. Yes, I might be on the verge of mildly insane. Who isn’t?

What other ways might you tell that you’re a writer?

by Kasia | Aug 1, 2016 | Business, Self Publishing

Why am I sharing my earnings with you? If you haven’t noticed already the online world is rather transparent. I like that. Money shouldn’t be a taboo topic. If you work hard you’re going to earn more. I read about bloggers making tens of thousands a month and I’m inspired and motivated to do the same one day.

Why am I sharing my earnings with you? If you haven’t noticed already the online world is rather transparent. I like that. Money shouldn’t be a taboo topic. If you work hard you’re going to earn more. I read about bloggers making tens of thousands a month and I’m inspired and motivated to do the same one day.

The regular earnings and expense updates are a way to stay accountable to my goals, keep a record, and share my journey with you.

The Australian Financial Year runs from July 1 to June 30, which means that it’s tax time in my part of the world. I like this time of year, generally, I’m pleased to find I get a decent tax refund. I’m sure if I had to pay June 30 and I would not be friends.

Unfortunately, June wasn’t the best month for income but I did sell a few books, so that’s great. I also hired a VA to help me out with a few things and am trialling a new editor for book 4 of my Lexi Ryder Crime Thriller Series which I hope to have out by the end of August.

To stay organised I keep folders for each financial year and I’ve also started a separate one for my business. It’s all under a sole trader. I don’t need the expense and complication of having a company (or corporation) just yet. Keeping things under my name, tax file number and business number is enough.

My record keeping isn’t fancy. I have a spreadsheet I use for my income, expenses, pitch submissions, blog schedule, etc.

HOW MUCH DID I MAKE AND SPEND IN 2015/16 FY?

2015/16 Earnings = $955.76 (freelancing, paraplanning, book sales)

2015/16 Expenses = $2,604.94 (this includes personal development courses, business coaching, editing and cover design. It does not include stationery, internet or home office charges).

(Obviously, I also earn money from my day job which I don’t include here but it does pay the bills at home!)

WHAT DID I DO TO EARN THIS CASH?

Not enough. Marketing and pitching were not high on the priority list this year. That obviously is going to change. Year one was more of a test run to see whether I’m interested in this gig long term. Yes, yes, I am.

I submitted 53 pitches, so about one pitch per week.

I had 24 responses.

I received 5 assignments and 1 sponsored post.

I sold 77 books and gave away 1210 books.

I’ve set up some affiliates but haven’t done much promotion. (You can’t make much money with affiliates if you don’t have traffic coming in!)

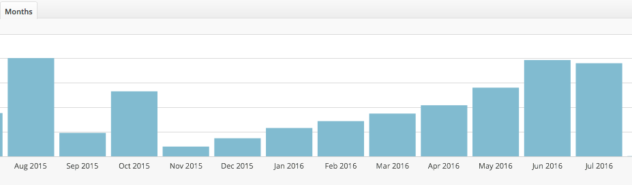

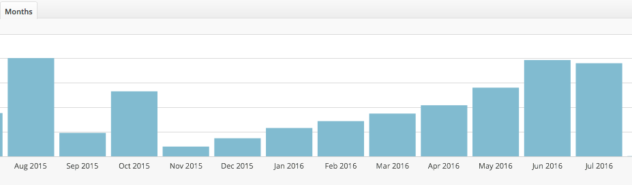

My website stats are small but I have big plans for the next financial year.

My expenses are 2.5x that of my income. Which sucks but that’s my fault. Not enough pitching and not enough marketing. I wasn’t going to do this post, the figures are embarrassing. But I want you to see that it’s not all rosy profits in the online world, not unless you’re really willing to work your butt off. I didn’t calculate all the hours I’ve put in but on average I can say that I’ve worked about 10 – 15 hours per week (approx. 624 hours per year) on my side business. Unfortunately, it wasn’t smart work. I’ve reassessed and I’m going to make sure financial year 2 is profitable.

2016/17 Financial Year Goal

Make at least $10,000 in writing income from a combination of book sales, freelancing, blogging and affiliates.

![Can You Really Make Money Blogging?]()

by Kasia | Jul 17, 2016 | Blogging, Business

$200 per month. $3000 per month. $15,000 per month. $170,000 per month.

$200 per month. $3000 per month. $15,000 per month. $170,000 per month.

These are just a few of the figures jumping around the blogosphere. Bloggers are making a killing with their words, online communities and traffic.. It’s not pocket change. In fact, it’s income that supports their families, businesses, and lifestyle. All of this passive income means bloggers can ‘retire’ much earlier. Can you imagine pulling in high five figures each month just from writing a few posts on your blog?

Ok, so maybe it’s not as easy as that but it is that simple.

Can you do it too?

If they can, so can you. Right?

Yes, anyone can make money blogging but not everyone will.

Blogging is more than just publishing a few posts each week. The bloggers making a living from their words and promotions have a strategy in place, and audience who loves them, and the ability to sell themselves.

While there is still a lot of opportunity to make money online through blogging, it’s by no means a get rich quick scheme. It takes effort, time, dedication and perseverance. Cash flow isn’t guaranteed and it’s likely that you’ll have to spend money to make money but that’s like any business, isn’t it?

So can you really make money blogging?

Yes, you can. But you have to be willing to treat it like a business from the get go. Sure hobby blogs might earn a couple of dollars here and there from Adsense. Some might even grow to be hugely successful and evolve into businesses. But why take the chance?

If you want to be a successful blogger making money you need to be in it for the long haul, with a topic you enjoy, and the willingness to experiment.

Here are just a few blogs who are making money blogging. Some have been at it a few months, some many years, they come from various backgrounds, but all share their love of blogging and helping others.

If these bloggers/writers/travellers/entrepreneurs can do it, so can you.

How are they making money?

Affiliates

The one thing that all of these have in common is that they earn money through affiliates. You can affiliate yourself with a company or brand and sell their products or services through your blog. When someone clicks on the link and makes a purchase you receive a portion of that. Sometimes it’s 4% sometimes it’s 50% depending on the affiliate you are recommending.

Freelance writing

Another income stream is freelance writing. Write blog posts and articles for publications and you can make anywhere from $20 per article to $2000 depending on your experience and who you are writing for. If you want to be a freelance writer, check out 30 Days or Less to Freelance Writing Success Course at Horkey Handbook.

Adsense

Adsense used to be popular. While it doesn’t generate as much income as it once did, it’s still a source of revenue worth trying if you do it properly.

Private ads

If you have a wide readership you might find companies or organisations willing to spend the extra buck to place ads on your website. You can charge whatever you like for these but obviously the higher your traffic the more you can charge for ad space.

Products

Why not create your own product? You can offer a service (eg. coaching) or a product (eg. course or ebook) and have a passive income stream that keeps on paying. Once you create a product you can sell it for as long as you want. There’s no time frame. Classics still sell today. Courses might need updating but you can continue offering them year after year with just a few tweaks.

Virtual Assistant Services

With more blogs popping up in the blogosphere, there’s been an increase in the demand for virtual assistants. If you enjoy helping others, are good with words, have strong attention to detail, know your way around social media and wordpress among other things, you might want to offer VA services through your blog. If you’ve been thinking about becoming a Virtual Assistant and working from the comfort of your own home working with business you’re genuinely interested in, why not sign up for 30 Days or Less to Virtual Assistant Success today.

These are just a few little ways bloggers make money. Some are stepping stones to something bigger, others are permanent gigs that provide variety, and a few might even become semi-passive income streams.

There has never been a better time to get started with a blog. Want to get started today? You can start your own blog in less than an hour! Click here to find out more.

What are you waiting for? Have you made any money blogging this month? What’s your most successful revenue stream? How long did it take you to start earning an income from your blog?

by Kasia | Jul 14, 2016 | Blogging, Motivation

Ever been in a funk that you can’t get out of? You know, one of those days where you feel like nothing matters, the world is falling apart around you, and all you want to do is crawl into a dark hole and disappear for a day, a week, a month, forever?

Ever been in a funk that you can’t get out of? You know, one of those days where you feel like nothing matters, the world is falling apart around you, and all you want to do is crawl into a dark hole and disappear for a day, a week, a month, forever?

Generally, the feeling doesn’t last too long but when it does, it’s hard not to wonder whether something sinister is at bay. Depression and anxiety are all too common in today’s society and the growing number of individuals on pills is a concern.

But I’m not here to get you down any further. In most cases there is something you can do, as it’s only you who’s in control of your emotions. It’s easy to lay the blame elsewhere but that’s not going to make you feel any better, at least not in the long term.

It’s ok to feel like shit sometimes.

No one is ever 100% happy, 100% of the time.

Humans do not work that way. We have numerous emotions that we go through in a certain day. Expecting to be constantly chirpy and happy and grateful is just asking the impossible.

You’re allowed to feel like crap.

We have good days and we have bad days. It’s unfortunate that society doesn’t let us experience our bad days as much as it praises our good days.

We constantly hear and see people’s successes, big and small, but rarely do they advertise their failures. It’s tough. Social media has made it even tougher.

We have become celebrities in our little worlds. Self-obsessed, craving for Facebook likes and Instagram follows. We don’t want to miss out on all the wonderful things out there.

But life doesn’t work that day.

Even the supermodel bestie posting cocktail hour in Tahiti has her bad days. You’re just seeing one of the good ones. But she’s not saying how she probably won’t drink it because of the calories. Or that she’s flown economy with a bratty-kicking toddler in the seat behind her. Or that her parents separated when she was a kid and she was teased at school for being lanky. Or the fact that she hates herself for something she did a decade ago. Or maybe she does have it all perfectly sorted. Either way, it ain’t any of your business.

We don’t see the background. We don’t see the bottom of the iceberg. We don’t see the full picture of anyone these days. All we get are tidbits, the pieces that people want you to see, and that’s generally showing a biased perspective.

Life’s a journey that sometimes gets hit with a tornado. You go through elation to depression to a happy medium. And while that might seem like you’re bipolar (please see your doctor if you’re worried about your moods), if these are just fleeting moments you’re going to be ok.

We all get shit days where the only thing that sounds appealing is getting into your comfiest yoga pants and jumper, wrapping yourself up in a blanket, and putting reruns of Revenge while you eat a block of dark chocolate and drink a bottle of shiraz (hey antioxidants anyone!).

You’re allowed to take a day off from trying to lead a perfect life. There’s no such thing anyway. And the harder you try to attain it, the more unhappy you’ll become.

Enjoy the good, embrace the bad. Live the life that you want and forget about everything else. There’s no right or wrong way if you follow your own path. Embrace what’s yours and realise that even amongst the shit, you can find your happiness.

Or become a writer.

Writing is therapeutic. You don’t even need to show your words to anyone. Just write and delete if need be. Or print the written pages and burn them for dramatic impact. You might surprise yourself and discover a hidden writing talent within. Maybe you’ll enjoy sharing your words with others and start a blog. Maybe you’ll do it all, or do nothing at all.

Writing is a healthy form of expression. The information age has allowed anyone with internet access to have a voice. But who’s going to hear you? It all comes down to how far your reach can go, and in an era where the world wide web is everywhere, your reach is infinite.

But if you write publicly be prepared to be ridiculed and abused. It’s bound to happen sooner or later. You’ll get upset. It’s inevitable. It’s also fine. Be upset, take a few breathes and a moment to recollect your thoughts. Move on. Don’t let trolls deter you from achieving your goals nor should you let them make you feel like shit.

But not all writing has to be made public. Sometimes a moment of journaling and reflection can shift your perspective. You don’t have to bare your soul, just hit delete. You’ll feel better either way.

Let writing help you get out of the funk. It’ll help you shift gears and accelerate your personal and professional growth.

In the end you are going to feel like shit sometimes. Others will make you feel that way too.

Feel it, move on. Even that shall pass.

The worst thing you can do is take out your funk publicly. You might want to blog about it, vent on social media, or argue your point in the comments thread but in the end you’re not doing yourself any favours other than adding fuel to the fire and one day it could come back to bite you on the backside.

How do you deal with your tough days? Have you ever used writing to help you get through tough times?

by Kasia | Jul 3, 2016 | Business, Self Publishing, Writing

‘There are only two certainties in life: death and taxes’ – Benjamin Franklin

‘There are only two certainties in life: death and taxes’ – Benjamin Franklin

For Australians, tax time is here.

Have you been a good record keeper the past twelve months?

While the chances of you being audited are slim Murphy’s Law says you’ll get audited just after you get lazy with your taxes. Just get it done right the first time and then sleep easy for the rest of the year.

The last thing you want to do is end up with a massive tax bill at the end of the financial year or the ATO (Australia) , HMRC (UK) or IRS (USA) or the equivalent in your country, knocking at your door demanding their money.

If you’re running a business you need to pay taxes. If it’s a hobby then you should be ok. But how do you know whether yours is a business or a hobby?

Good question.

It doesn’t come down to just how much money you bring in but also how you conduct yourself on a day to day basis.

Some questions to consider:

Do you have a business and marketing plan?

Is your intention to make a profit/run a business?

Are you putting in specific hours each week to work?

Are you selling your work for a profit or just to cover costs?

Do you promote your work?

If your intention is to turn a profit, then it’s likely that you are running a business.

Each country has different tax/business laws so make sure that you check out the rules and regulations for your area. Your best best is to give the taxation office a call or speak to a qualified accountant.

In Australia, the ATO website has an easy to use questionnaire that you can use to help you decide whether your venture will be treated as a hobby or as a business. You can check out the questionnaire here.

UK – Working for yourself?

US – Starting a business?

If you’re in Australia as I am, June 30 is the end of the financial year. Australians have till the 31 October to file their tax returns unless they’re registered with a tax agent.

Hopefully, you’ve overpaid rather than underpaid so they can get a nice refund to spend on a holiday or more books and stationery to fill their shelves. It’s like getting a little bonus without doing the extra work!

Deductions

If you’re a writer/author/freelancer who makes money and intends to make a profit rather than just to cover your expenses then you should speak to an accountant to ensure you are deducting the right things.

I love deductions. It’s all those little things that can reduce your tax bill significantly. Charity donations are the most common deductions that people use. Have you given money away to charity this year? Make sure that you keep a receipt for everything you’ve donated over $2. You can claim it at tax time.

As a writer making a dime you might be able to claim the following:

Toner and paper

Notebooks and pens

Internet connection

Subscriptions

Editor, VA and cover designers costs

Business Coaching

Professional development courses

A percentage of your phone bill

(I’m not a tax professional so this is just general advice. Speak to an accountant in your area who can assess your needs based on your activities and location. Different countries, different rules!)

Plan ahead

If you’re working for yourself then you’re probably already putting away a portion of your income to cover taxes. If you have a full time job and freelance on the side you should also be putting cash away for the tax man to collect.

* Put away at least 20% for taxes from your first payment

* Get an ABN (Australian Business Number) or the equivalent in your country. In Australia if you don’t have the ABN 49% of your income could be sent straight to the tax office.

*Do you need to register for GST (Goods & Services Tax)? If you’re earning under $75K then probably not. Planning on earning more? Check with your accountant.

*Keep all your receipts – you need to prove what you’re spending and deducting

*Record all your income and expenditure – you can click here to see what I use

*Maintain an invoice system

*Get an accountant!

If you’re not sure as to how much tax you should be paying each year, start putting aside 30% until you speak with an accountant. If you are able to forecast how much you anticipate earning then check out the tax brackets that apply to you. If your earnings fall below $18,200 (in Australia) then you won’t be paying any tax. If you plan on earning $35K, then start putting aside 20%, $80K, 35%, over $150K aim for 45% just to be on the safe side.

In the second year, the ATO will tell you how much you need to pay quarterly based on the previous year’s earnings. If you anticipate on earning more, make sure you put that little bit extra away so not to get bitten with a nasty tax bill come tax time. Your best bet is to speak to an accountant so they can advice you based on your personal circumstances. Their fee will be tax deductible the following financial year so keep your receipt!

No body likes paying taxes. Unfortunately, if you’re earning an income paying tax is inevitable.

How do you handle tax time? What are some things that you are able to deduct? Do you use an accountant or do you do your own?

It’s taken a while to own up to those terms. I might not invent a life saving machine or something on par with Branson’s out of this planet joy ride, but I’m doing what brings me a sense of satisfaction. How about you?

It’s taken a while to own up to those terms. I might not invent a life saving machine or something on par with Branson’s out of this planet joy ride, but I’m doing what brings me a sense of satisfaction. How about you?